Take Advantage of the Tax Bill

Invest in Equipment, Save Big!!

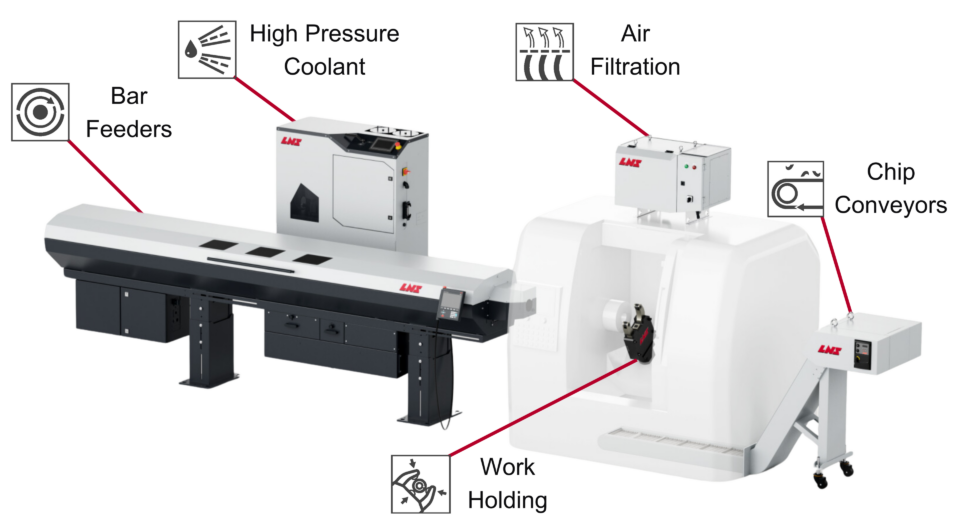

With the recent passage of what’s being called the “One Big Beautiful Bill,” your business now has powerful new ways to save on equipment investments—and that includes machine tool accessories LNS offers.

Here’s how you can benefit immediately:

⚙️ How This Helps Your Business

✅ Section 179 Deduction

Take up to $2,500,000 in immediate deductions on qualifying equipment purchases placed into operation for 2025. This allows small and mid-sized businesses to reduce taxable income by writing off the full cost of qualifying equipment in the year you place it into operation.

✅ 100% Bonus Depreciation

Deduct the full cost of qualifying purchases—new or used—in the first year. This includes manufacturing equipment, machinery, and facilities placed in service between January 19, 2025, and January 1, 2030.

✅ R&D Tax Credit

Businesses can once again fully deduct R&D expenses that your business incurs during the year—reversing the previous requirement to spread those costs over five years. This pro-innovation change gives manufacturers greater incentive to invest in new ideas, accelerating the development of cutting-edge products and technologies.

Email: sales@LNS-northamerica.com

Phone: 513-388-5035

Email: orders@LNS-northamerica.com

Phone: 704-734-4666

Email: salesdept@LNS-northamerica.com

Phone: 814-813-2443

Email: salesdept@LNS-northamerica.cm

Phone: 814-813-2443

Email: epeter@LNS-northamerica.com

Phone: 513-675-1265